Scams are like weeds—they keep popping up, no matter how many times we pull them out. And this week? They’ve gone full-blown invasive. Whether it’s a suspicious $215 Apple Pay charge you never made or a phone call claiming your Medicare benefits are about to vanish, fraudsters are banking on fear, urgency, and confusion to trip you up.

But don’t worry. We’ve rounded up the top scam tactics doing the rounds right now so you know exactly what to look out for—and what not to fall for.

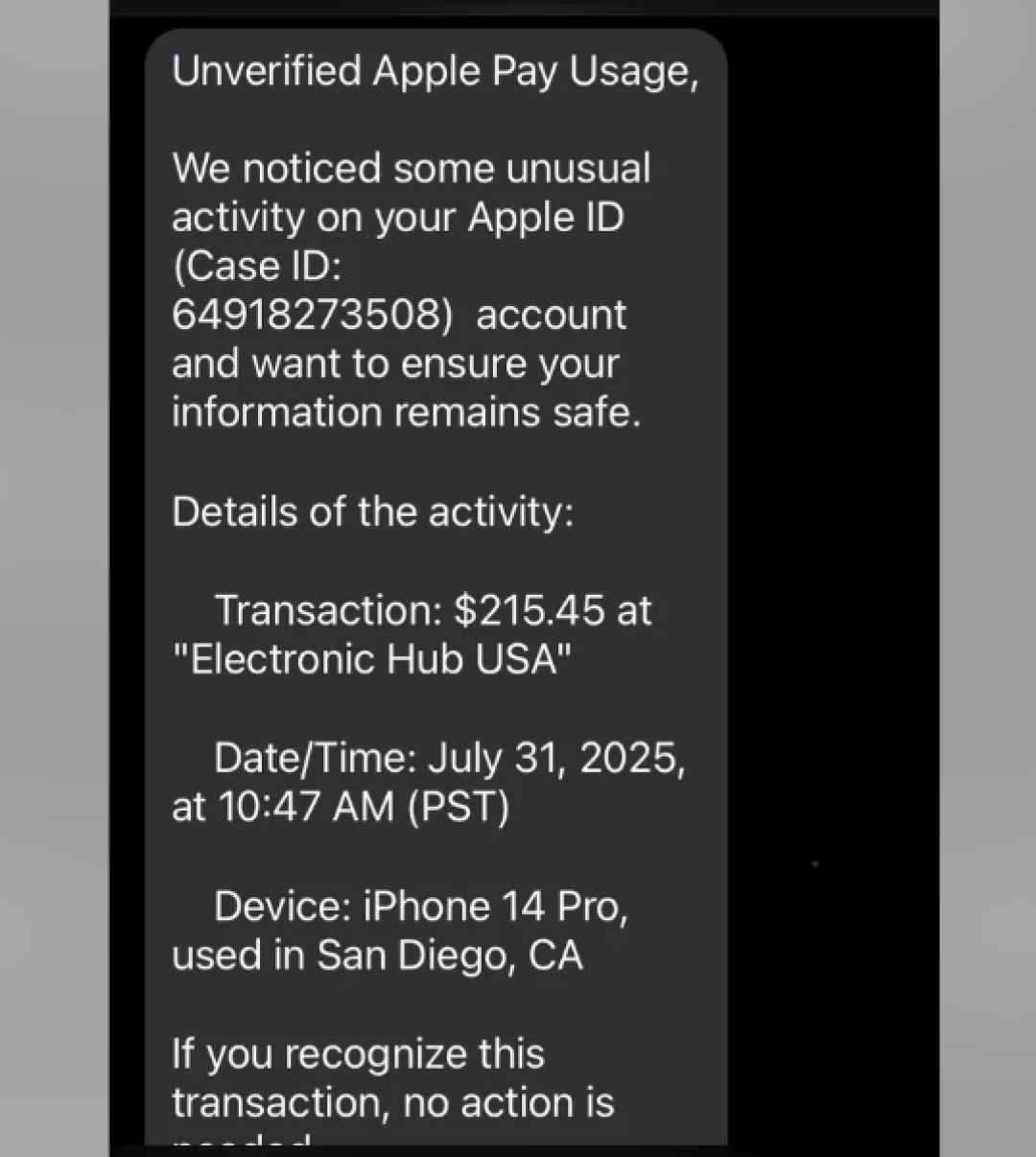

This scam is dressed up to look like an official email from Apple, complete with a fake case ID and details that are just convincing enough to scare you into action.

The message reads something like:

We noticed some unusual activity on your Apple ID (Case ID: 64918273508)... Transaction: $215.45 at "Electronic Hub USA"... If this wasn’t you, contact Apple Support immediately.

It even mentions a specific iPhone model, location (San Diego), and a made-up support link to make it feel legitimate. But it’s a trap.

This phishing email is designed to get you to click the fake link or call the fake number—handing over your Apple ID login, payment details, or worse.

What to do:

Scammers are still dialing in on seniors, pretending to be from Medicare with alarming claims or tempting offers. Their goal? Your Medicare number, Social Security details, or banking info.

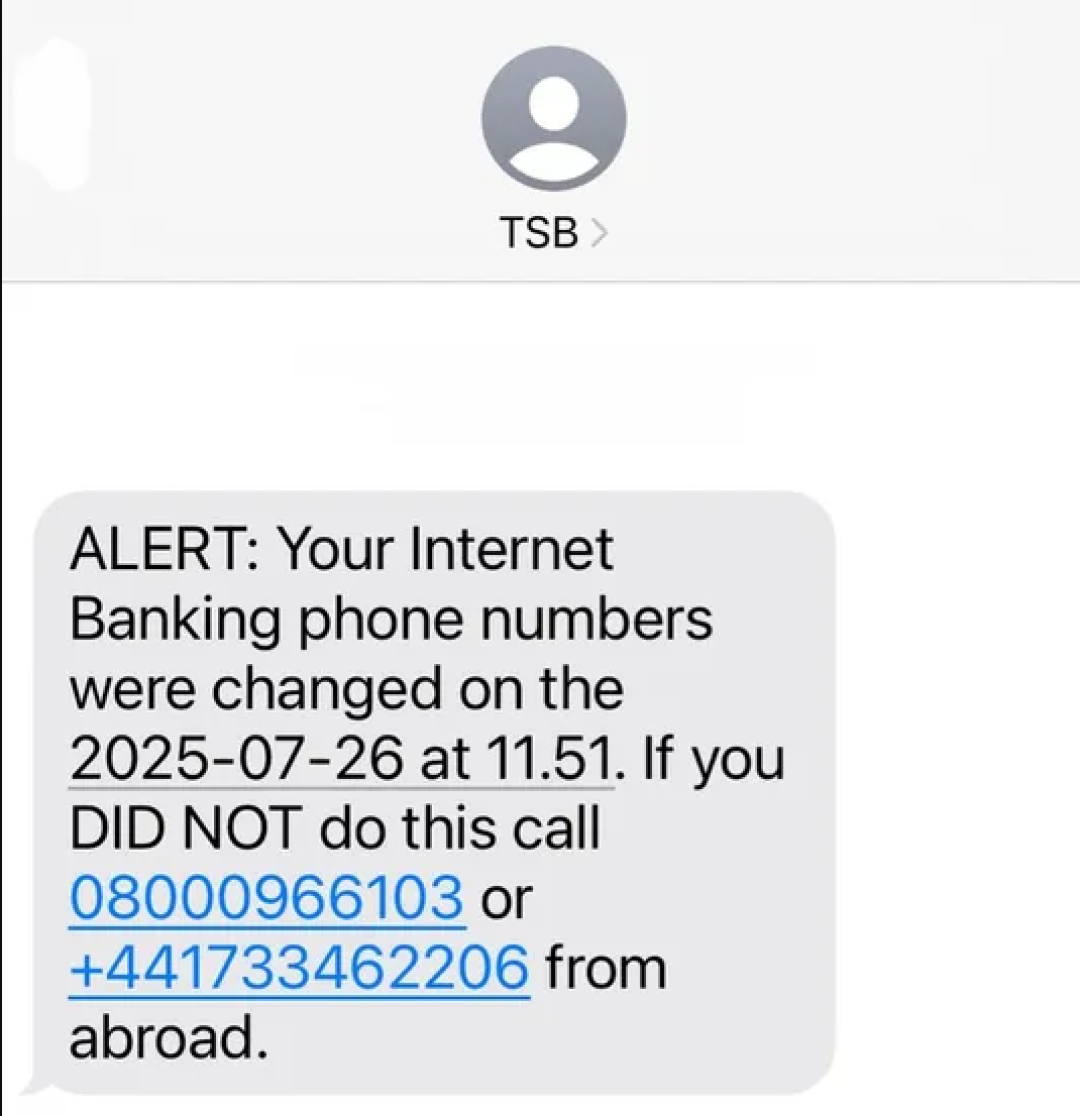

This one’s alarming and clever. A text shows up claiming to be from TSB Bank, warning you that the numbers linked to your account have changed.

It urges you to call a number—where a friendly fraudster awaits.

The catch?

Even people who don’t bank with TSB are getting these messages. And those who do bank with TSB have logged into their accounts only to find that nothing has changed.

The danger lies in the call.

The number in the message connects you to scammers who’ll ask for your banking info under the guise of “fixing the issue.”

From spoofed emails and fake bank alerts to phone calls disguised as healthcare help—scammers are upping their game. But you can outsmart them by staying alert, thinking twice before clicking or calling, and always verifying through official channels.

Before You Go:

Scammers are getting slicker by the day—but you don’t have to make it easy for them. Want a quick way to spot dodgy websites, shady links, or offers that sound too good to be true? Download the ScamAdviser App and check before you click. It's like having a scam-spotting sidekick in your pocket.

Spotted a scam we haven’t covered?

Share it with us through this form. The more we know, the better we all stay protected.